When someone dies ‘intestate’, it means that they died without a valid will – a pretty common problem in the UK, where more than half of all adults don’t have one.

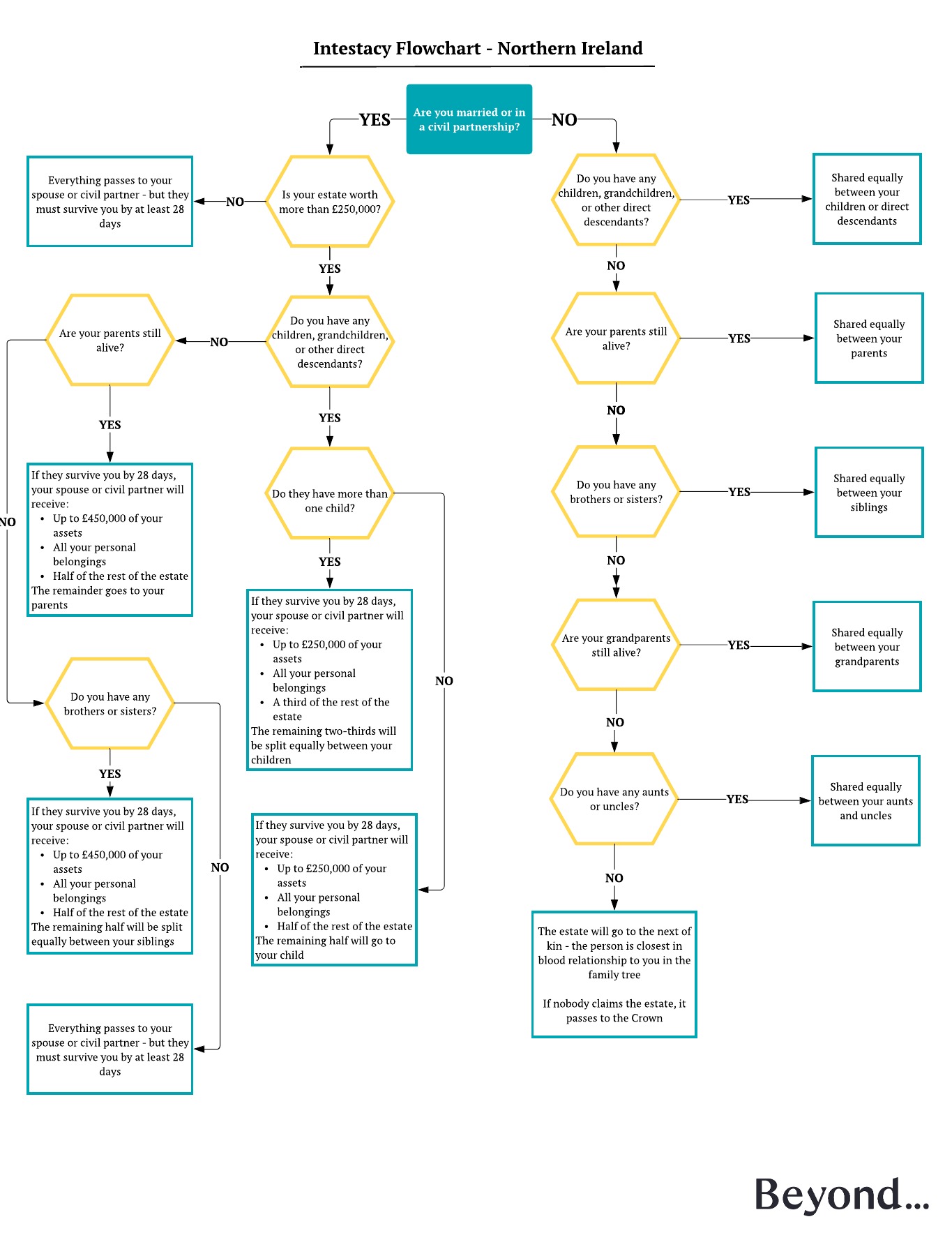

What happens to the estates of people who die without wills depends on the law of the land. Here, we’ll be explaining the intestacy rules in Northern Ireland, with a handy flowchart to make things simple. Not your location? You can check out the guidelines for the rest of the UK here.

Let’s begin…

What are the rules of intestacy for Northern Ireland?

When someone dies without a valid will, their estate usually goes to a close family member. You can use our flowchart to get a solid idea of who it might be in your case (just bear in mind the flowchart is from the perspective of the person who has died). Or, alternatively, you can click here to skip ahead to a complete breakdown of Northern Ireland’s intestacy rules.

Who inherits if someone dies intestate in Northern Ireland?

The consequences of dying intestate in Northern Ireland are very different if the person who has passed away was married or in a civil partnership. Click the link below to skip to the relevant section:

If they were married or in a civil partnership…

If the person who has died was married or in a civil partnership, their husband, wife or civil partner will likely inherit at least some of the estate. How much depends on the situation. Scroll down or click an option below to see what happens.

The person who has died without a will has…

- An estate worth less than £250,000

- Children

- No children, but their parents are still alive

- No children or living parents, but had siblings

- A spouse or civil partner but no children, no living parents, no siblings

Married, with an estate worth less than £250,000

If the estate is worth less than £250,000, the spouse or civil partner of the person who has died will get everything.

Married with children

If the person who has died has children, their spouse/civil partner will get:

- Up to £250,000 of the estate’s assets

- All their personal belongings (clothes, furniture, jewellery)

What’s left over will then be divided up:

- If they have one child, their spouse or civil partner will get half of what’s left over, and their child will get the other half

- If they have more than one child, their spouse or civil partner will get a third of what’s left over, and the remaining two-thirds will be split equally between their kids

Married without children, parents are still alive

If the person who died didn’t have children, but their parents are still living, their spouse/civil partner will get:

- Up to £450,000 of the estate’s assets

- All their personal belongings

- One half of what’s left over

The other half of the estate will be split equally between the parents.

Married without children or living parents, had siblings

If the person who has died didn’t have children or living parents, but did have brothers and/or sisters, their spouse or civil partner will get:

- Up to £450,000 of the estate’s assets

- All their personal belongings

- One half of what’s left over

The other half of the estate will be split equally between the siblings. If one of the brothers or sisters has already passed away, their children (the nieces and nephews of the person who has just died) can inherit their share of the estate in their place.

Married without children, no living parents, no siblings

If the person who has died didn’t have kids, siblings, or living parents, their spouse or civil partner will inherit everything.

If they weren’t married or in a civil partnership…

When the person who has died isn’t married or in a civil partnership, the estate will go whoever comes next in the official order of intestate succession. In Northern Ireland, the order is as follows:

- Children or direct descendants. If they had children, the estate will be split equally between them. If one of the children has died before them, their children (the grandchildren) can inherit their share. The same goes for great-grandchildren, and so on.

- Parents. If there are no children or other direct descendants to inherit, the estate will pass to the parents.

- Brothers and sisters, or their children. Siblings come after parents in the Northern Irish rules of intestacy. If one of the brothers or sisters has died first, their kids (the nieces and nephews of the person who has just died) can inherit their share.

- Grandparents. If the person has none of the relatives above, the estate can be split equally between their living grandparents.

- Aunts and uncles. Failing that, the estate will fall to any aunts and uncles. As with siblings, if one of the aunts or uncles has died already, their kids (the deceased’s cousins) can inherit their share.

- The Crown. If no other relatives can be found, the estate will be claimed by the Crown.

Now that you know the intestacy rules for Northern Ireland…

If you need to settle an estate, we offer a fixed-fee probate service across the UK. Call our wills and probate service for advice or a quote on 0800 054 9896, or drop us a message using the comment box below. Find out more here.